By Brooke Sinclair

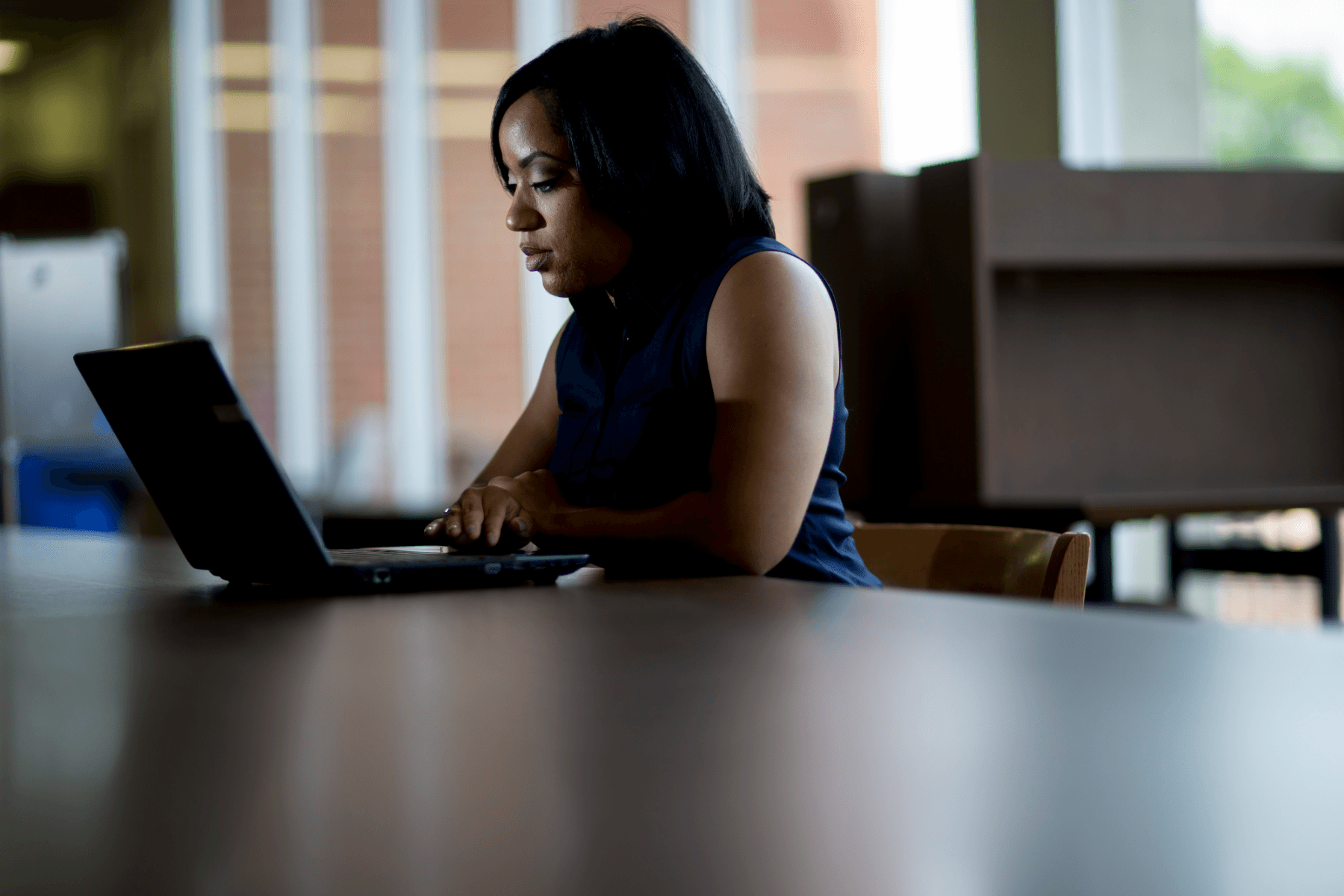

- Fearless Fund is a vital force in supporting Black women by providing a platform of empowerment for African-American-owned enterprises

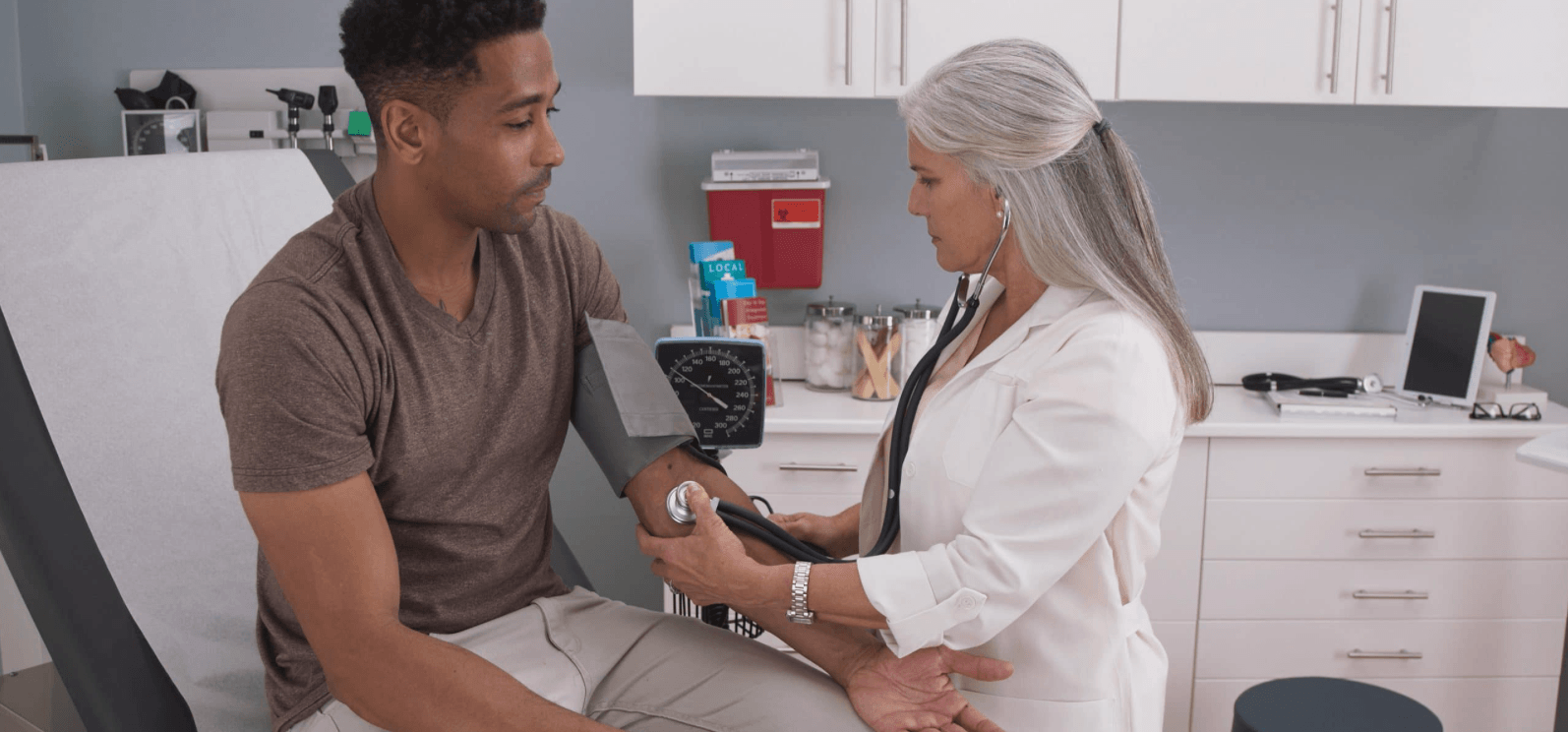

- Black women were the fastest-growing demographic of entrepreneurs, with nearly 3 million businesses across the U.S. from 2014 to 2019

Fearless Fund is a vital force in supporting Black women by providing a platform of empowerment for African-American-owned enterprises. However, the tides have turned and only smart venture capital funds that adapt will survive. Notably, the Fearless Fund has also backed African American-owned enterprises like Capway, as they venture into the competitive fintech space. When it comes to protecting your fund from a lawsuit the best defense is the truth.

Why This Matters: This complex tale of systemic inequality pivots around a recent legal clash. The American Alliance for Equal Rights (AAER), founded by a conservative activist instrumental in the U.S. Supreme Court’s June decision rejecting affirmative action, has taken aim at the Fearless Fund.

To protect one’s firm from predators who attack race-based investing, smart fund managers understand the direct correlation between students who attend ivy league schools, technology, and stock investments. Nearly 83% percent of Harvard’s investment arm, Harvard Management Company, holds securities investments in four of the largest technology companies. They include Microsoft (MSFT +0.27%), Apple (AAPL +0.85%), Meta (META 0.17%), and Alphabet (GOOG -0.40%). Students with ivy league degrees often run diverse funds with assets of $1 billion, but focus on investing in tech startup founders from their alma mater.

Seeking safety in the truth and adopting race-neutral policies of lineage and ethnicity like Freedmen or nonFreedmen is the way some fund managers may want to evolve. Smart fund managers understand they have the power to change things—and at some point—everything must end. Ending race-based investments with colorblind evaluations based on merit guarantees your firm respects each founder’s individual contributions to their culture and academic achievements with race-neutral, merit-based investing.

Situational Awareness: Race-neutral investing creates the equitable environment fund managers need to protect their firm from future lawsuits and keeps America from becoming a quota-ridden society.

CBX Vibe: “Wild West” Kool Mo Dee